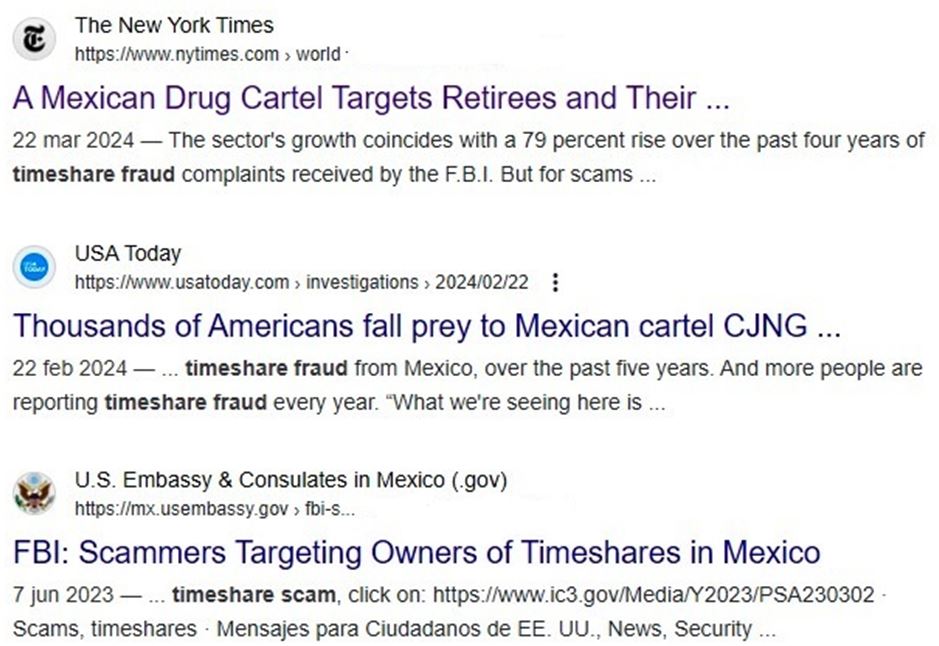

Last month we published an article highlighting the sort of investigations you need to carry out before buying a timeshare, today we will look at the sort of research you need to carry out to avoid becoming the victim of fraud relating to timeshare sales, exits and claims. Over the past few weeks both the UK and American press have been highlighting the extent of a particular timeshare fraud being perpetrated against owners of timeshare in Mexico. As an example, the New York Post published an article about a victim who lost $1m! One of Mexico’s most violent criminal groups, Jalisco New Generation, runs call centres that offer to buy retirees’ timeshare, and then proceeds to empty the victims’ bank accounts.

The operation is relatively simple. Cartel employees posing as sales representatives call up timeshare owners, offering to buy their timeshares back for generous sums. They then demand upfront fees for anything from listing advertisements to paying government fines. The representatives persuade their victims to wire large amounts of money to Mexico, sometimes as much as hundreds of thousands of dollars, and then they disappear.

As we said earlier, the news of this scam is extremely current as far as news sources are concerned but the odd fact is that it’s not new, far from it, so victims still falling for the scam could have found plenty of information about why extreme caution would have been advisable, but didn’t.

Hindsight is a wonderful thing

If only I knew before I did it! Well that’s all OK, but if you had the ability to know before you did it and didn’t, then who is to blame? In the States there is a nationwide consumer protection body known as the Better Business Bureau (BBB). Here we are in 2024 reporting on a current surge of Mexican timeshare scams and yet the BBB published a comprehensive warning in early 2020 and have subsequently published lots more, the latest of which we found was August last year.

In the beginning months of 2020, the BBB began to receive a number of complaints from consumers that owned timeshares in Mexico. According to reports, owners were receiving several “unsolicited offers” for their timeshare that were well above the actual value of the product. While some victims simply received a phone call, many others fell for the ploy, losing thousands of dollars along the way.

In fact, one owner in St. Louis claimed to have handed over more than $11,000 before $50,000 worth of bank fees deterred him from paying any more. These types of scams work because timeshare owners believe they’re getting out of the contract by selling it and making a handsome profit. It could be described as a once in a lifetime opportunity.

Nonetheless, offers appear to be made by professional companies with genuine buyers. Otherwise, victims wouldn’t take the bait. According to the BBB’s publication, this is usually done by email or directly over the phone. Authentic looking paperwork and contract to sign to make it appear like a legitimate transaction. However, all the scammer wants is for their targets to send them money.

Investigation

For the purposes of this part of the article, it matters not where your timeshare is located, investigation to avoid being scammed is universal:

- Approach by cold call, email or SMS is the first red flag.

- Research any business and its owners carefully before paying any money.

- Check that the company is legally registered.

- Check the address is a real office, not a virtual office.

- Check they have a website.

- Check how long the domain has been registered for.

- Be wary of anyone claiming they have a buyer for your timeshare or who promised to rent it, especially if they ask for an upfront fee.

- Before paying, make sure you have a studied the contract outlining what is to be done, a timetable, and an explanation of what happens if the business doesn’t fulfil the terms of the contract within the specified period of time.

- If in the EU or UK, under distance selling regulations you have 14 days cooling off during which time by law, no monies must pass hands. Use this time to research.

- Never be pressured into snap decisions, take time to research.

In the USA

- Check with BBB’s Scam Tracker to report or learn about scams.

- Pay by credit card whenever possible because if it goes wrong you may be able to challenge the payment.

If you feel like you have been misled, file complaints with BBB and the state’s Attorney General’s office.

TCA comment

It doesn’t matter whether it’s a Mexican cartel or a couple of wide boys working from an apartment in Tenerife, fraud is fraud. Prevention is far better than cure, TCA would be the first to admit that fraudsters are getting smarter and more proficient by the minute, and now, more than ever, potential victims need to be one step ahead of the scammers’ game. TCA are here to assist and are more than happy to help if investigation and carrying out your own due diligence seems daunting or overbearing.

For more information regarding this article or assistance in any other timeshare related issues please contact the TCA on 01908 881058 or email: info@TimeshareConsumerAssociation.org.uk