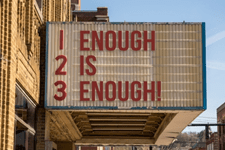

Before we launch into the body of this article first we would like to publish a rogues gallery of those timeshare developers who are systematically cheating people out of monies that they not only deserve, but also have legal rights to these being the funds awarded by the Spanish courts. We will then explain why enough is enough.

Rogues gallery

- Silverpoint

- Club la Costa

- Anfi

These are the companies that have used the Spanish legal system to the full and fallen over at every fence in attempts to avoid the inevitable. We shudder to think of the total number of affected timeshare owners and the millions of Euros that have been rightfully awarded by the Spanish courts but never paid. Add to this the thousands of owners with these developers who have been cheated but haven’t come forward yet and the numbers get frightening.

A brief history

After the change in Spanish timeshare law in 1999 it was established that many resorts and developers either didn’t understand, or chose to ignore the letter of this law. In 2015 the first Spanish court case took place, the verdict of this was guilty, the defendant was Anfi.

Since then thousands of cases have been presented to the courts with very few awards from guilty verdicts being satisfied. Much like many other countries, Spanish law has the right to prosecute companies found guilty of not actioning court orders against them, but there is a way out.

Bankruptcy

When a company becomes insolvent and can no longer service debts to creditors it enters administration followed by bankruptcy. In genuine cases one has to feel for companies in this position, however when such action is engineered to avoid paying debts, this can only be described as despicable behaviour.

Setting the future game plan

Silverpoint, who many readers will know, was the sales company formerly known as Resort Properties. They were responsible for selling timeshare at Beverley Hills Club, Beverley Hills Heights, Hollywood Mirage and Palm Beach Club amongst others, all on Tenerife. When hundreds of court cases went against them for selling timeshare with illegal contracts, in February 2020 the company was placed in administration.

Questions have been raised as to how a company whose previous accounts revealed that they were in a very healthy financial position could suddenly become insolvent? Where did all the money go? Silverpoint were part of the larger Limora Group which consists of 123 companies so it became a very easy task to move Silverpoint funds to one or many of the other companies within the group thus placing themselves in a position of insolvency.

The game plan was now set and so it didn’t take long for Club la Costa and Anfi to jump on the “insolvency” bandwagon and follow suit. These bankruptcies didn’t happen overnight, they were both pre meditated and carefully planned which involved taking cash rich companies into penniless organisations by means fair or foul.

The clever part of this deliberate action is that the companies declaring bankruptcy were only the sales companies within the groups so the resorts themselves carry on as if nothing has happened.

They are still collecting maintenance fees, allowing holidays, maybe even selling new timeshare through another company within the group. Some might say a win win scenario.

Right or wrong?

On ethical and moral grounds this type of action is wrong. From a legal standpoint we know for a fact that the authorities in Spain are investigating both Silverpoint and Anfi. We also know that lawyers representing claimants are issuing law suits against the individual directors of said companies. We are certain that the laws covering insolvency both in the UK and Spain were never enacted allowing such fraudulent behaviour to go unchecked.

How are you affected?

We appreciate that if you are a claimant you must feel both frustrated and aggrieved that after what may have involved considerable funds spent, substantial time and expertise of your legal advisors with the result of a successful outcome for you, however only in a few cases has financial recompense has been forthcoming. We have no doubt you are saying things like:

- How can they do this to me?

- Why does the law seem to turn a blind eye?

- How do these companies get away with it?

- Why aren’t the authorities helping?

- Will I ever get paid?

If you have been personally affected by either Silverpoint, Club la Costa or Anfi please let us know. We feel so strongly about the treatment of those affected that and would like to hear your story and comments on the matter. Please feel free to express your feelings below.

We would value hearing your opinion about the action taken by these developers especially if you are a victim. Even if this doesn’t directly affect you but you are a timeshare owner, again we would value your comments.

One way or another, these organisations need to be held accountable for their actions. Legal advisors who presented their cases to court and won are working tirelessly to bring this sorry state of affairs to a conclusion and force the perpetrators to settle all outstanding claims rightfully owed their clients, because as the title of this article states “Enough is Enough”

For more information regarding this article or assistance in any other timeshare related issues please contact the TCA on 01908 881058 or email: info@TimeshareConsumerAssociation.org.uk