Carrying out a rough calculation we would say that timeshare fraud reported to TCA during 2021 runs in excess of £1m. The emphasis is “reported to us”, from this we cannot calculate the exact extent of the fraud as many victims never contact us so who knows the real total. One thing is for certain that apart from credit card payments, the banking industry offers little or no assistance for those who have been victims.

Whilst the voluntary code adopted by certain banks has assisted, it falls far short of adequate measures to prevent fraud or offer meaningful redress if such fraud occurs. It isn’t strictly fair to lay blame totally at the door of the financial institutions there are other pieces that fit into the fraud jigsaw that need addressing. So are there changes afoot?

Tightening the screw

According to a recent article published in the Daily Mail there may be greater efforts to stamp out fraud on the way. According to the article there are some rather dramatic figures; fraudsters stole £754million from unsuspecting Brits in first six months of 2021 according to the banking industry trade body UK Finance, The total taken from households last year is expected to be around £2 billion, and this sum is likely to rise further as fraud is the fastest-growing crime in Britain. Finally there seems to be some moves by MPs to address this issue. Tory MP Mel Stride, chairman of the Treasury committee, blasted ministers for being ‘flat-footed’ in their response to the spiralling epidemic of online fraud.

To add credibility to the scam, victims are often directed to the “corporate” website. According to the Mail report, millions of users are estimated to be targeted via websites each year. The suggestion is that tech giants such as Google and Facebook could be forced to pay out to users who fall victim to fraud on their sites under proposals set out by MPs. A ‘financial responsibility’ needs to be imposed on social media firms, MPs said

Whilst this is all very encouraging, questions may be, how long will this take? Will the tech giants play along? What checks and balances will need to be put in place?

At TCA we have seen many examples of websites, a good number extremely professionally produced, the commonality is they are all created and registered by fraudsters. In virtually all cases the owner of the site is hidden behind a privacy shield. Creating and publishing a website is easy and not that expensive and given the so called trustworthiness and credibility websites give to companies they certainly are a big part of the fraud jigsaw puzzle.

Creating fake identities

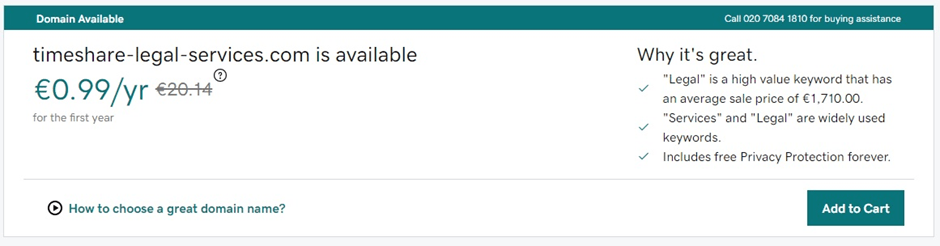

So you’re interested in becoming a timeshare scammer, the first thing may be “what do you call yourself?” How about Timeshare -Legal -Services, that sounds good, now for the website. Can I get that domain name? You sure can and it will only cost 99 cents then €20 per annum thereafter, see below:

Website content is also easy, there are copious articles on Mr Google of how to clone a website so you find a good timeshare related website, clone it and use it as your own. The domain name can also feature in email addresses such as; seniorlawyer@timeshare-legal-services.com all very impressive and all of the perpetrators details are hidden from view by the privacy shield. All of this achieved with no checks and balances carried out by the domain provider. Name, address, pay up and the domain name is yours.

Add a Voice Over Internet Protocol (VOIP) phone number and even though you are in Timbuktu you can pretend to be in London. Simply add a fake London address and voila you are good to go.

Checks and balances

It’s certainly good to see that MPs seem to not only be aware of the problem but are looking to act but isn’t their approach attempting to crack a nut with a sledge hammer. In no way can we imagine that the powers that be at Google or Facebook will agree to be held responsible for fraudulent web content. Maybe a better idea would be to remove the privacy shield and demand security documentation such as certified copies of passports, driving licences etc before being allowed a domain name. For legitimate organisations this presents just a little more red tape, for scammers it could be the end of the road.

More about money

Online banking and plastic cards are now the premiere way of handling payments, however this is not a one way street. To take money electronically or even by the old fashioned bank transfer route requires a receiving account. No fraudsters will ever have their own account used, that would be crass stupidity, so in the case of bank transfers they use payment “mules”. For the most part these are people down on their luck and for a percentage of the deposit they will act as a clearing house. If caught, however, they can still be charged with benefitting from the proceeds of crime but as it’s unlikely they will never know who “Mr Big” is they are unlikely to be of much assistance to the police.

Plastic presents another problem. To take payment by this method you need what is known as a “merchant facility”. Nowadays these are extremely difficult to obtain. A considerable amount of information and evidence is required before such a facility is offered and we can state without fear of contradiction, scam companies will fall over at the first fence. So how do they accept cards?

Enter the third party merchant or payment gateway, these services are provided by a number of companies, probably the most famous being PayPal. Their requirements are somewhat easier to obtain a facility rather than those of banks. The cost is greater than a clearing bank but it solves the problem of taking plastic. If all else fails there are “wire transfers” such as Western Union.

Is there a solution?

Of course there is. A suggestion ventured in the Mail article is to make the banks repay customers for every fraud, this is on the basis that it would force the banks to review their anti fraud policies otherwise they are presented with an open chequebook scenario. This actually is the crux of the matter, repairing fraud is pointless and expensive, stopping it must be the only way forward. This article points towards some much easier fixes for the Government to action that doesn’t involve using the banks as a buck stop or trying to persuade the tech giants to jump on board.

Bearing in mind that the age demographic for most fraud seems to target the senior citizen, perhaps the banks should put greater investigations and support in place for this age group.

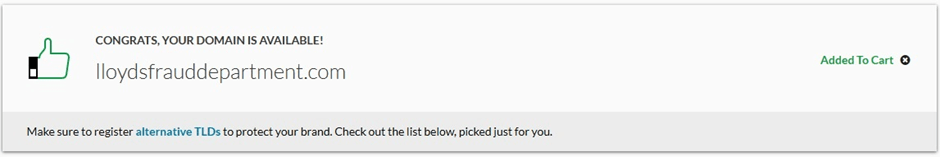

We looked at domain names earlier on; perhaps there should be a global moratorium on like sounding domain names. Imagine if you received an email from investigations@ lloydsfrauddepartment.com it might make you think it’s real, have a look below:

The domain name Lloyds Fraud Department is for sale on the open market, how can this be? If this isn’t an open door to a scammer, what is?

Finally

Whilst putting legislation in place, and the stronger the better, it’s not the panacea to all ills. As adults we all have to take certain responsibilities for our own actions. Fraud often starts with an unsolicited phone call or email; this is where the first alarm bell should ring. How does this caller have information about you that you haven’t shared? The same applies to email.

If there is any request for money during this contact, this is the second alarm. Never pay any monies on the strength of a single contact, do your homework, investigate thoroughly and only if you are 100% happy then think one more time. If your bank question the payment this is a good signal that they are trying to protect you, take their comments as another reason to carry on your investigations. Remember if you override the banks advice then this will almost certainly stop any chance of reversing the transaction, by you saying you authorise the payment you have removed any responsibility the bank may have had.

If you do wish to proceed then ensure you use a credit card, not a debit card and certainly not a bank transfer if it’s to a named account as opposed to a company account.

Remember, even the most astute of us can fall prey to scammers. The Daily Mail article had foot notes prepared by Alexander Brummer, City Editor for the paper and even he admits to being a victim:

“Almost all of us will, at one time or another, have been a victim of push-payment fraud and I am no exception, having been tricked out of £70 by a bogus DVLA website.”

So if someone who moves in financial circles and is knowledgeable in these matters can get scammed, what chance for the rest of us?

As a visitor to this website we assume you have an interest in timeshare, unfortunately both past and present owners are firmly in the gun sights of the scammers. As we have said before, if you don’t have the ability to do your own checks and balances get in contact with us and we will help you. We will attempt to head off the scammers at the pass, but only if you get in touch. Despite our experience and advice, even we cannot do anything if the horse has bolted and the stable door is closed.

TCA are supporters of the banking industry Take Five initiative created to help stop fraud, we suggest you view their website and familiarise yourself with the help contained therein and more importantly, act on it.

Remember the title of this article; Timeshare fraud – Who pays for it, for now it’s the victim. Until changes occur, if ever, you need to be on your guard. TCA has a white list of companies we know can be trusted, we also have a black list. This article is a warning against the latter and as we always say, we are here to help you stay safe whilst advising on the good guys who can actually do what they say they will do.

For more information regarding this article or assistance in any other timeshare related issues please contact the TCA on 01908 881058 or email: info@TimeshareConsumerAssociation.org.uk