As an organisation we often find it hard to engage the authorities and report blatant fraud when we discover it. Many scam operators leave very little clues as to their whereabouts with no registered company or websites hidden behind privacy shields makes it both difficult for us to track them down which in turn presents the same problems to the authorities. When solid evidence is presented we can then jump into action. One such case happened lately.

Interbank scam

We recently published an article relating to a Club Class scam orchestrated by a nonexistent company named Interbank. Having read the article a potential victim contacted us to say she had been approached by said Interbank to inform her she had been awarded £32,000 as the result of a court case in Spain, naturally she was cautious and at this stage she nearly paid the £4,000 they requested but thankfully had an online banking problem. Luckily in the interim she found our article and contacted us. Needless to say she went no further with this scam but the point of interest is that the scammers gave her a UK bank account in which to pay the funds, this was music to our ears.

Clydesdale Bank

The account was in the name of a sole individual and using the sort code of 82-63-10 we quickly established that the bank was Clydesdale and the account was held in their branch at 28 Market St, Ellon, Aberdeenshire, AB41 9JE. Furthermore we had both the full name of the account holder and the account number.

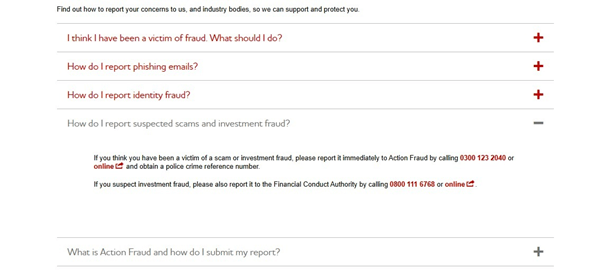

Our first step was to contact Clydesdale to make them aware that this account may be used to “launder” proceeds of crime. We spoke with a very helpful gentleman in customer services who correctly pointed out that such fraud reporting was above his pay station so he placed us on hold whilst he contacted the Clydesdale fraud department via internal call. After a period he returned and explained that our only course of action is to report this to Action Fraud, this is borne out by the fraud section on the Clydesdale website as shown below:

The problem

At the time of writing it cannot be said for certain that any proceeds of crime had been received by the account holder. All we were suggesting is that the account may be having transactions involving deposits and movements out of line with the normal account activities. For this reason we suggested that the account be flagged as being possibly fraudulent, something we established Clydesdale cannot do.

Regular readers will know the protection afforded by the UK banking system, when making transfers, is lax to say the least, unlike the protection afforded to credit card transactions. Being able to nip fraudulent transfers in the bud would have appeared to us as a worthwhile step thus building a layer of additional consumer protection, sadly as far as Clydesdale are concerned this does not appear to be the case.

From previous investigations carried out we have no reason to believe that the account holder has anything to do with the perpetration of the fraud. Many people who are down on their luck get suckered into acting as a clearing house for crimes not only related to timeshare. By allowing their accounts to be used by fraudsters they get to keep a percentage of the transfers going through the account perhaps not even knowing why or where the funds originate. Unfortunately for the account holder they are in a position where they too can be prosecuted if it is discovered that they were assisting criminals.

The solution

Quite simple really, banks should be more reactive to potential fraud at customer level. It’s all very well to have fraud departments set up to catch the big boys but when collectively the relatively small monetary amounts are added up by timeshare fraud this runs into millions. Although £4,000 may be small fry to a bank, it can be a life changing sum to lose especially when most timeshare fraud is aimed at the elderly who can ill afford to lose such sums. The lady in this case is truly into retirement and has been for a good number of years.

Naturally we shared our evidence with Action Fraud and because the account is in Scotland, the Scottish Police.

Our Comment

Above all be very wary about anyone who cold calls you out of the blue. We can categorically state that all calls you receive saying you have been awarded a substantial sum as the result of a court case will be absolute lies. Carry out your own extensive research and due diligence, involve us if in doubt.

Never pay any money on the strength of a phone call. If you do feel comfortable then insist on paying by credit card, this route offers the greatest protection. Under no circumstance make any bank transfer to a single named individual; ask yourself, what reputable company wouldn’t have a corporate bank account.

Finally, given the inadequate fraud protection surrounding bank transfers if you are the victim of fraud expect little or no assistance from your bank. The chance of recovering your funds is slim to zero so the message is… don’t do it!

For more information regarding this article or assistance in any other timeshare related issues please contact the TCA on 01908 881058 or email: info@TimeshareConsumerAssociation.org.uk