Timeshare claims in Spain – No doubt you may have read that the rules relating to both new timeshare purchase and existing ownership that were the subject of an overhaul of European law. The Timeshare, Long-Term Holiday Product, Resale and Exchange Contracts Directive 2008/122/EC (the Directive) was adopted in March 2012. This Directive was designed to contribute to the important objectives of boosting consumer confidence in the timeshare industry and to eliminate the operations of rogue traders, which bring legitimate traders into disrepute and cause considerable problems for consumers.

As a “maximum harmonisation” Directive, member States were obliged to implement its provisions in national law in a way that accurately reflects, does not exceed, or fall below the requirements in the areas it covers. Although the Directive offered substantial consumer protection not previously available, the Spanish were well ahead of the game and took it to a higher level.

Timeshare Claims in Spain – The Background

After an earlier EU Directive, Spain implemented Law 42/1998 which was enacted to protect purchasers of timeshare products. The law came into effect on the 5th January 1999. On January 15th, 2015, a ruling of the Spanish Supreme Court had a significant impact on owners of Spanish timeshares. The Supreme Court ruled that all contracts signed after 5th January 1999 must be for less than 50 years, thus outlawing the practice of “perpetuity contracts” which had been prevalent since the 1980s.

Encouraged by this ruling, more timeshare consumer challenges have been presented to the Supreme Court. It has since been confirmed that resorts are obliged to give clients a ‘cooling off period’ that is designed to give consumers adequate time to consider the purchase. It is illegal to accept any monies or have the client sign for any finance agreement during this period. The initial period of 10 days (Law 42/1998) was later extended to 14 days (Law 4/2012).

In addition, the Supreme Court has also ruled that any timeshare sold since the beginning of 1999 must state the details of the apartment/unit/week(s) purchased, together with the time of arrival and departure.

Failure to comply with these rulings can end up with the contract being deemed Null and Void with owners being eligible to receive a refundofmonies spent on the purchase of their timeshare plus interest and in some circumstances penalties. With the law now firmly on the side of the consumer, can you benefit?

How does this apply to me?

Firstly it would need to be established that you purchased your timeshare after 5thJanuary 1999. And obviously in a Spanish territory (Mainland, Canaries, Balearics). Furthermore, the purchase contract must have been issued by a Spanish registered company and must show one or more of the following now illegal clauses:

- Your contract length was more than 50 years or in perpetuity.

- You contracted a floating time or points backed timeshare.

- Your timeshare was not registered in the land registry.

- You were not provided with the exact details of the occupancy rights.

Reading contracts is not everyone’s forte so it is advisable to contact a competent Spanish lawyer for confirmation. Subject to a potential claim being established, you are as they say, good to go.

The Process

To reiterate, for timeshare claims in Spain, this is a legal process and will require presentation to Spanish courts. The lawyers will request all supporting evidence in order to compile and present the claim including but not exclusively the following:

- A copy of your timeshare contract, agreements and annexes signed with the Resort.

- Proof of all payments related to those agreements and annexes (loans included).

- Proof of payment of the instalments and/or maintenance fees and services.

Once all the evidence is collated, the lawyer will present this to court. The Spanish legal system is somewhat different to the UK. In the UK many court cases are won or lost on the law of “Precedent”, meaning that a century old court case may well be cited as evidence to assist the judge in making his decision. Spanish legal codes and laws are rooted in Roman law, as opposed to common law, which is based on precedent court rulings. In Spanish proceedings it is common that ‘the judge is bound by law and not by precedent’. So although many timeshare owners may have previously won their cases, the court will view evidence as if it is the first case ever presented because there will be little recourse to precedent.

What is the effect of this on your claim? Probably, in the final analysis, not a lot but what it means is sometimes a protracted case. Here is a worst case scenario, albeit unlikely this may be the road ahead:

Court process in Spain

First: The Judge receives the claim from the plaintiff or claimant.

Second: This claim is served to the defendant. The defendant has 20 days to reply.

Third: After replying, a preliminary hearing is scheduled (only for lawyers and Procuradores to present evidences (documents, witnesses and timeshare experts, among others). The Judges decides which evidence is needed for the proceeding.

Fourth: After the preliminary hearing, the main hearing is scheduled, on very rare occasions it is at this stage the clients may have to go to Court (cross examination), in addition to some timeshare experts, depending on the previous stage.

Fifth: After the main hearing taking place, the Judge will issue his/her Court Ruling (Some take two weeks; others can take a few months. There is no general rule for this).

Sixth: After the Court Ruling, the parties have 20 working days to submit the appeal at the Court of Appeal

The Appeal Court or Audiencia Provincial will have an open hearing, but the parties usually do not plead for it,the case is reviewed by three Judges, then a Resolution is again issued. The Court process in Spain is such that generally the case will stop there as very few cases go to the highest level of Court, the Supreme Court (Tribunal Supremo de España).

As stated above, in the matter of a timeshare claim and given the powers enacted in law 42/1998 this example would be highly unlikely but it serves to illustrate that on average court cases take much longer is Spain than in the UK so be prepared to have patience!

Given all of this you may be thinking that you will be flying in and out of Spain on many occasions to attend court, not so. Only in a small minority of cases will you need to attend court. Giving a notarised and apostilled “Power of Attorney” to a Spanish lawyer instructing them to represent you in court is not a difficult process. It can be arranged through a UK public notary at a minimal cost and will no doubt be suggested early on in your case.

The Costs?

Of course such legal work will bring associated costs and it would be wrong to second guess fees payable, these will be based on the complexity and expected work load to complete the case. Most lawyers will work on a fee plan to spread the cost and bearing in mind that on a successful case you would be entitled to financial compensation, they may also offer reduced front end fees and take a percentage of the awarded amount.

Most timeshare lawyers will receive support from a third party generator and funder. This company will promote the legal services available in an effort to assist prospective claimants and then they will offer to part fund the claimants’ legal costs; agreeing a percentage split upon success. For example if a case costs £8,000 to bring to trial, the funder may offer to pay £4,000 towards the cost and will expect a pre-agreed percentage of the successful outcome. Financially this makes a lot of sense and allows the claimant considerable peace of mind.

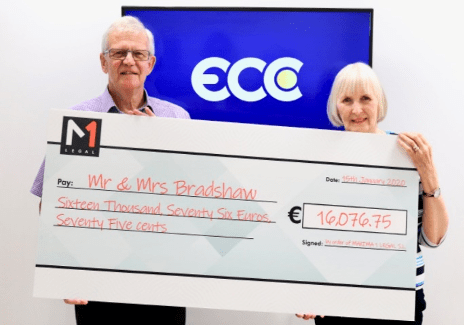

In all successful timeshare claims in Spain, your timeshare contract will also be annulled, resulting in no further maintenance fees or monetary commitments. As stated above, the claimant may not receive the full amount paid to the Resort, just the purchase price, depending on the years that have passed by since the contract was signed. In some occasions they may receive the interest from any loan agreements used in the purchase process.

Another very important and significant part of the law states if you paid any monies within the first 90 days of signing your timeshare purchase agreement, you may be awarded double the said amount in compensation for timeshare claims in Spain.

Given the success of companies such as European Consumer Claims (ECC), Canarian Legal Alliance and M1 Legal it is clearly evident that financial recompense is achievable through the Spanish legal system, but to make this happen you really need to engage the services of a specialist claims company or a Spanish law firm; not only that but a law firm whose speciality is timeshare consumer claims.

For more information regarding this article or assistance in any other timeshare related issues please contact the TCA on 01908 881058 or email: info@TimeshareConsumerAssociation.org.uk